For as long as I’ve made chocolate, the global commodity price for cacao beans (determined in trading houses in London and New York) was absurdly low. The price was so low that cacao has been a poverty crop for most farmers, one that doesn’t even support half of a “basic living income” as estimated by the World Bank.

The cacao price has been that way since the late 1970s!

Of course, we never paid that price.

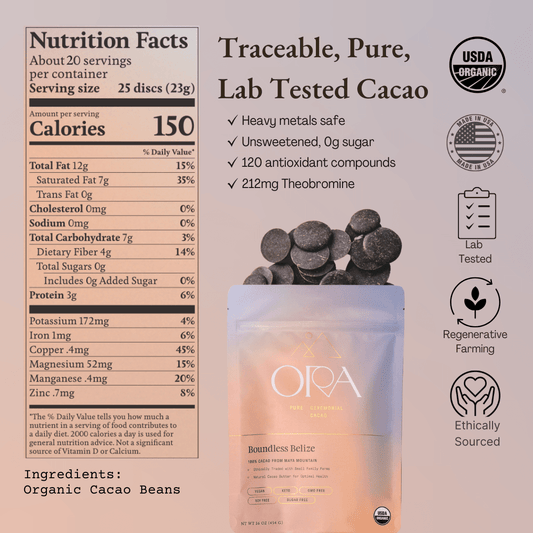

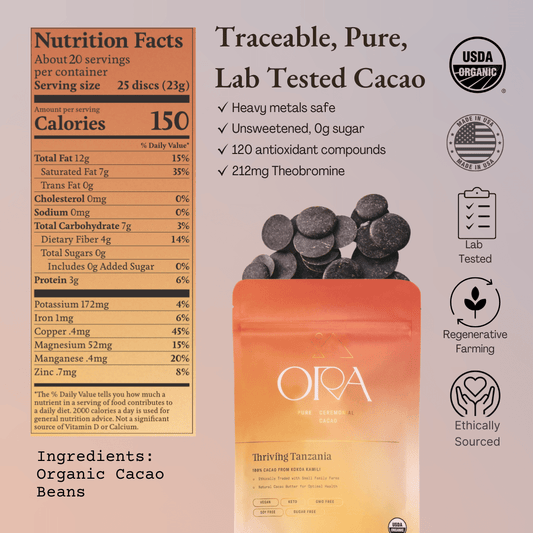

Supported by people like you who care about ethical sourcing, the typical price we paid with direct trade was 4x the global commodity price. That’s because true to ceremonial cacao values, we wanted farmers to make a good livelihood and we wanted growing cacao to have a regenerative impact on the land.

As fate would have it, now the rest of the world is seeing the negative impacts of decades of astronomically low commodity cacao bean prices. In the last few months, the global cacao bean price has skyrocketed, doubling already this year alone and quadruple of what it was just two years ago.

Big Chocolate’s pricing cartel that has kept prices artificially low to keep people consuming more cheap candy has literally toppled! This is an epic systemic collapse, and I don’t see the price backtracking substantially in the near future because the human and ecological realities of growing cacao are finally affecting the price of cacao.

Factors behind this massive rise in prices include:

1) Blistering droughts and torrential rains in West Africa, where the majority of cacao going to the commodity market is grown.

2) Substantial spread of cacao diseases both due to extreme weather, aging trees, and conventional monoculture planting of cacao.

3) Declining yields due to aging cacao trees and reduced soil fertility - decades of low prices have prevented farmers from reinvesting in their farms, and farms need input and replanting to stay productive.

4) This is actually the third year of cacao shortages. But the already large shortages of the previous two years consumed a massive global inventory designed to ride out smaller shortages.

All together, a shortfall of up to 300-500 thousand tons of cacao is predicted - possibly the largest ever. All of the factors putting upward pressure on the price of cacao beans right now are not things that are easily remedied in the coming years. I predict the cacao price may still go much higher.

For the benefit of millions of cacao farmers, I hope it stays there.

Agricultural crops are notorious for boom and bust cycles. It’s clear that we are experiencing a generational change in cacao. If we are able to leverage this change to bring better livelihood and sustainability to the cacao sector, it could be a permanent disruption of the status quo.

Finally, the era of ludicrously cheap chocolate candy is over.

People are talking about “demand destruction” as the only way out, which means higher prices for candy. Already, the biggest chocolate factories in the world have had to partially idle their lines because they can’t get enough cacao beans in their doors.

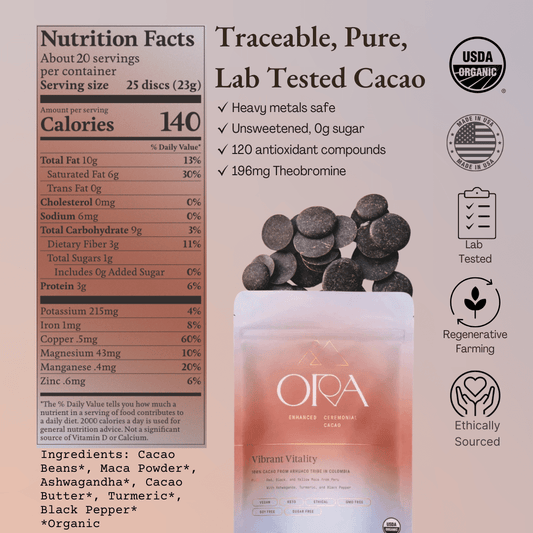

How does this affect Ora Cacao?

- We get to pay farmers even more now :-) Historically, the world market price was largely meaningless to us, and our price was mostly decoupled from it. But now that the world market has caught up with what we used to pay, of course we’re paying more. We’ve already upped the prices we are paying by 50% to stay ahead of the global market price. That goes straight through - for example in Belize, our farmers are now receiving 50% more than we paid previously. I can’t underscore enough how huge this is for the communities there. Our farmers are also hugely fortunate, because in our direct trade model they see immediate benefit. Many farmers globally are stuck in contractual prices that will only increase in the coming seasons, but they don’t see immediate benefit while the intermediaries and trading houses make big cash.

- We are facing increasing pressure in securing cacao. Because of the global shortage, buyers from all over the world are descending on the remote places that we source from looking to purchase huge volumes of cacao. Nothing is for sure certain until a container ships. Fortunately most of our partnerships are robust and the cacao crops are doing well as we don’t buy from West Africa. In Guatemala though we are facing the combined challenge of severe drought, low harvest volume and quality, and increased competition for cacao. While we’re working hard on it, we may not have Glowing Guatemala back until 2025 :-(

- We’re going to be leaning more into various forms of business financing to pay for our cacao bean purchases. Historically, we’ve been able to save just enough cash for the next container that we’ve been able to forego most traditional financing for inventory, but with the price increases that ties up more and more business capital. So we’ll be financing more of it - a little new and uncomfortable for us, but very common for most businesses.

Accordingly, we’re making a minor raise to our list prices (about 10%) beginning in April. We deeply desire to balance quality with keeping the medicine of cacao affordable, so we’ll also be introducing subscribe and save discounts to whoever wants to lock in a good price.

Have questions? Ask away. It’s a truly fascinating time to be in the cacao world and we are so grateful for your support.

Kindly,

Jonas